Many laws on the books are legal – until they are not. It was once legal to own slaves – now its not. Even back in the day, people like you argued that owning slaves was legal – until it wasn’t. Your position holds no water…Your argument that, just because something is legal now, it should always be considered valid law, worthy of support. Wrong – some laws should be abolished, especially if they fly in the face of the Constitution… I am arguing for the removal of property taxation and the subsequent seizing of homes, from the authority of county governments. Again I claim that the act of seizing homes for ‘back taxes’ is in direct violation of the Fourth Amendment to the Constitution (even though this arguement was defeated in prior judicial rulings). I disagree with the ruling, and think that it should be revisited under evidence provided below. I know it will probably get your dander into a tizzy to hear this fact, but even the Supreme Court can get it wrong. Now breathe calmly…deeply.

Yes, I have done plenty of digging and looked at the many arguments for and against property taxes, most all of which claim that it is legal. The Supremacy Clause, however, states that if laws are in conflict, the law of a higher authority can preempt the law of a lower authority if the superiority of the former is stated expressly or even implied.

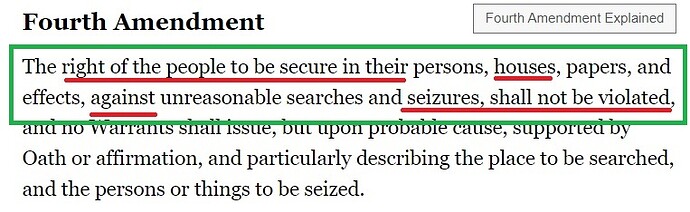

That being the case…let’s use the Constitution’s Fourth Amendment (being the higher authority) to “imply” that State/County laws (being the lower authority) seizing their homes for tax debts, is UNCONSTITUTIONAL. Here we go, …(and remember to keep the logic of your argument for county seizure of homes within the confines of the happy little green box that I painted for you, as it is the supreme law of the land)…

Now, from what seems clear (from my two seconds of research and a healthy application of proper English), the Supremacy Clause may be applied, such that, county governements cannot seize homes for county debts without mitigating the threat to the security of the person having their home taken from them. Currently, no such security is given…someone owes $500 on ‘back taxes, the state seizes their $100k home, leaves the person and their belongings out on the street, and simply replies with “its just the law’. (And don’t pull “but its ‘reasonable’”, from out of your backside).

Unless you can demonstrate where that “security” might exist, where a person can enjoy being secure in said home (like our Constitution insists), I really dont think you have an argument. Wondering every year if the county is going to steal your home for unrealized property valuations which may not be affordable or even payable, is simply NOT SECURITY. This is not complicatedl law – its simple English and simple logic, no matter how much you might want to glorify or justify unconstitutional statism, or your grandeous opinions of self-importance.

Thus, without bloviating on extensive case law, color of law, prior precedence, etc, simply drop a nice quaint bit of proof that state/county debt law can override the fourth amendment of the constitution. The text in it is quite straight-forward (Queen’s English, even). Counter it now – don’t just make noise and call it a counter-arguement. Tell the world right now how the underlined text above, in the Fourth Amendment DOES NOT mean what it says, or secretly means something entirely different. I don’t see any conditions on the amendment, like “People should be secure in their homes – but only if they make eternal extortion payments to the County Government.” I dont see any conditions on that 4th Amendment security promise – like “you can be secure in your home, but only if you dont owe any debts.” It’s not in there. The text that exists is so precise and short that you can’t invent an exception to it, can you? You can’t twist it. It is what it is – it must really trouble you, huh? And since the Constitution already penned it (expressly without any exceptions or conditional clauses), the State/County cant step in and add conditions to it. They simply have to CONFORM to it. Teeth grinding yet?

In the mean time stop telling the world that it is NOT a Constitutional issue, and that states can openly violate the Constitution in this regard, or I will continue to tell you that you are neck-deep FULL OF IT. And since I know that you might reply with a very long diatribe of self-gratification, throwing in a few internet links defending state-sponsored theft, and perhaps a lecture on why laws should stay as they are, because you were always used to them staying that way in the past, I will end the exchange and bid you a nice day. ![]()

PS - I dont recall you being in any of my computer engineering classes, so I cant say how long you have been staring at your own law books – but I am sure happy to have had a discussion with something that YOU are supposedly familiar with…I wont bore you with exacting and mundane engineering concepts.